Analysis of shopper visitation during lockdown & how shopping patterns are adjusting to the new normal

GapMaps has been at the forefront of device data usage for analysis of customer patterns at shopping centres and retail precincts for a number of years. In this article, Simon Newberry shares his insights on shopper visitation from data collected by GapMaps.

“Device data, sometimes referred to as mobile device data provides powerful insights into usage patterns at individual and different retail formats. Device data is collected via numerous avenues on smartphones and can be quickly and effectively utilised by any shopping centre to monitor the changes in its customer attraction patterns.”

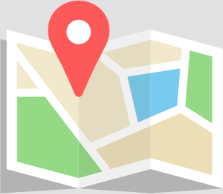

Looking at different retail typologies in KSA and Dubai we can see a clear picture of depressed visitation levels during the lockdown period and the emerging patterns as retail destinations open up.

Chart 1 shows identifies an index of unique daily visitors for different retail typologies across Dubai and KSA. All centre types experienced a dramatic fall in patronage post lockdown with regional and tourist destinations showing the most dramatic fall. Neighbourhood centres in both Dubai and KSA maintained greater levels of visitation reflecting their orientation towards convenience retail activity.

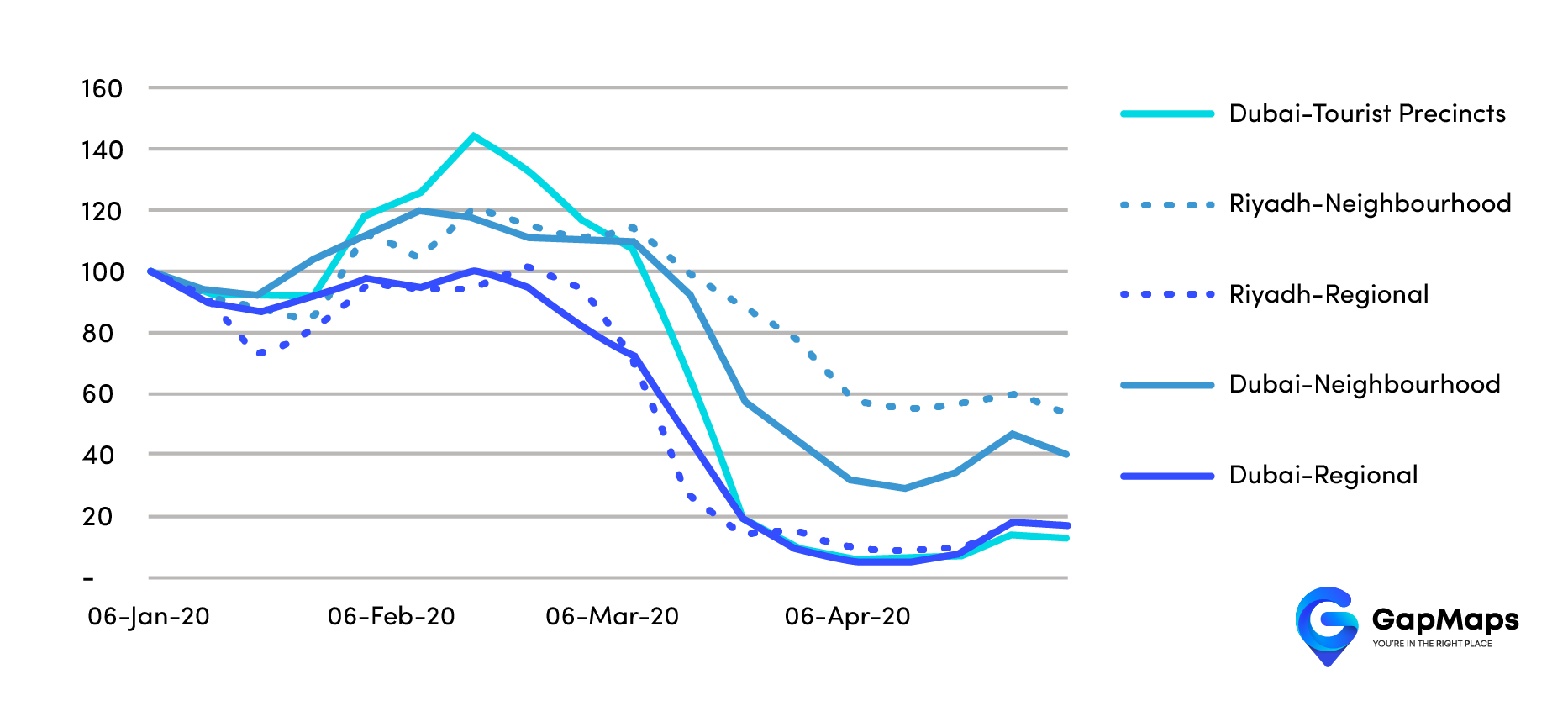

Chart 2 identifies the proportion of unique daily visitors originating from within 5km of the destination. Some change is evident in convenience based centres although the regional centres can be seen to have behaved like local centres during the lockdown with a fall off in visitation from beyond 5km. The early trend evident from mid-April suggests that visitation patterns for regional and tourist locations are beginning to return to a broader regional draw.

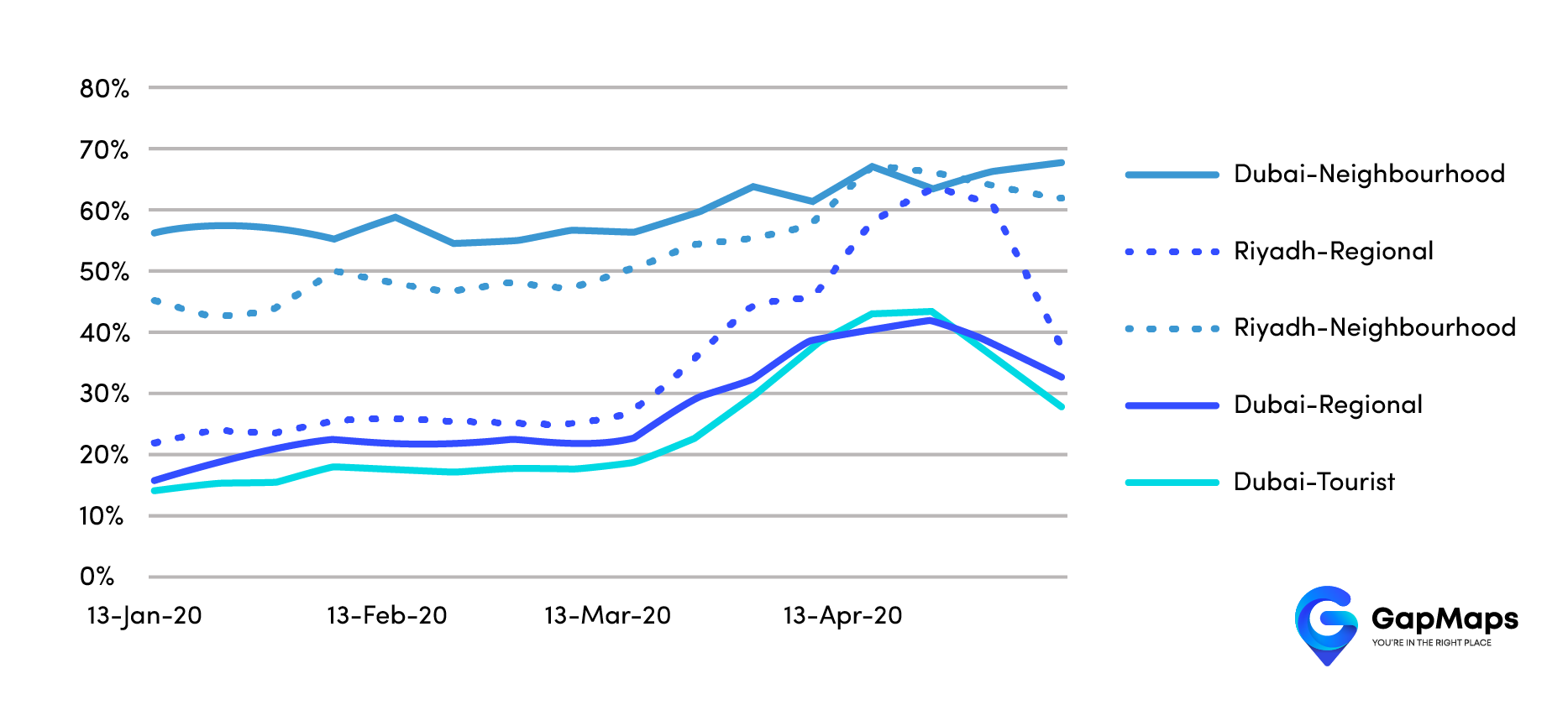

Chart 3 shows the share of visitors at the weekend. Whilst the timing of the lockdown is a factor, as we emerge from the lockdown the weekend shopping peaks are less apparent with shoppers distributing their mall visits more evenly across the week.

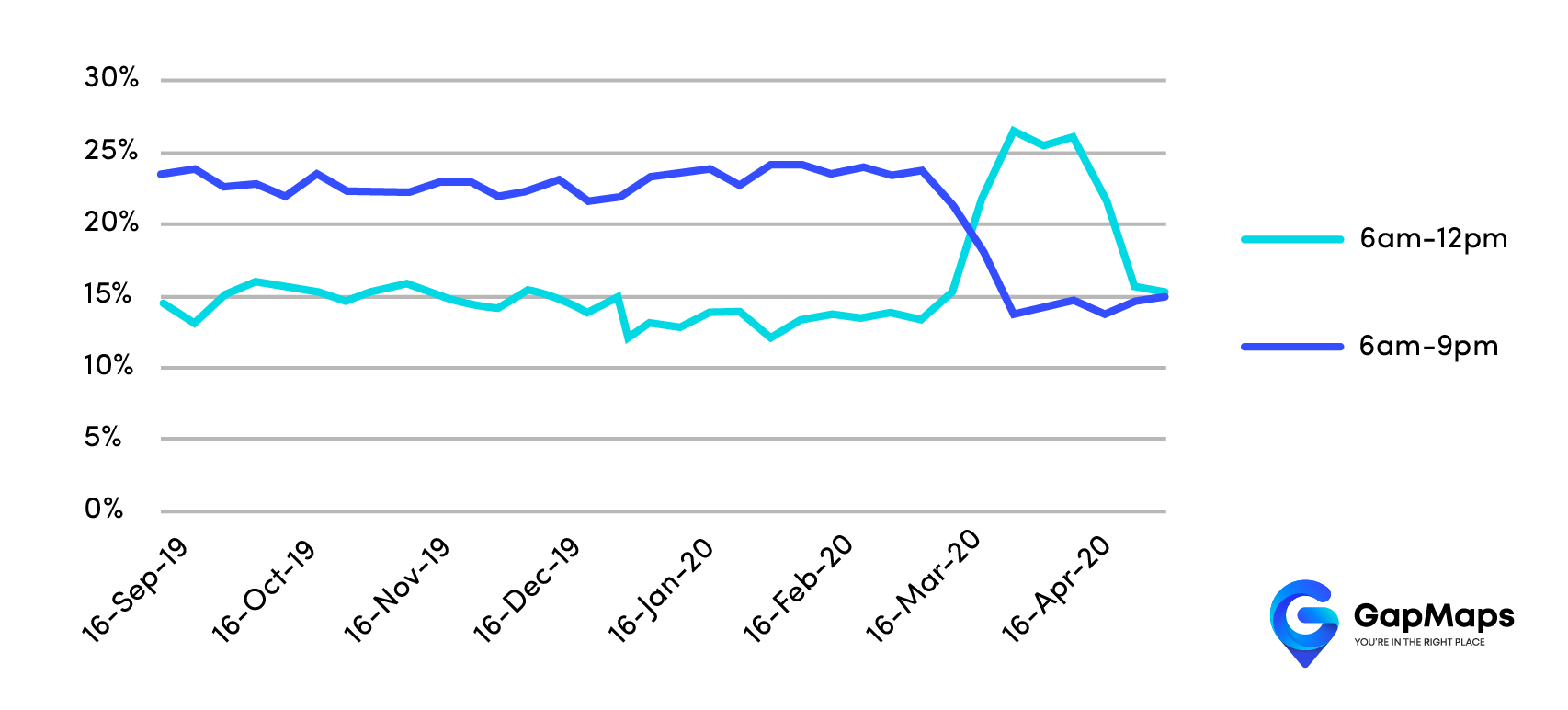

The region’s preference for evening shopping was clearly impacted by the lockdown and post lockdown restrictions on opening times (Chart 4) with morning shopping clearly gaining in significance. With lockdown restrictions eased evening shopping remains subdued, whilst shoppers are returning to sleeping in with the share of morning shopping trips returning to pre lockdown levels.

Perhaps it is too early to tell whether regional centres will continue to behave as local centres or whether the daytime and daily shopping habits through lockdown become established behaviour in a post-COVID context. In any event, an understanding of these changes in shopping patterns will be important for retailers, developers and managers in planning their future activities. Next month we will explore these ongoing trends in shopping behaviour taking into account the impact of Eid-al Fitr.

This analysis provides the opportunity to track the recovery period and understand the nature of changes in visitation patterns for different retail types, different locations and even from each trade area sector for an individual mall.

If you need any further information, please contact us at gcc@www.gapmaps.com